Everything you need to know...

-

What is the fee?

Home: £9,535 per year

International/EU: £17,155 per year -

How long will I study?

3 / 4 Years

-

Where will I study?

-

What are the entry requirements?

-

What is the UCAS code?

N4N3

-

When do I start?

September 2025

-

Placement year available?

Yes

1. Course summary

- Experience practical accounting in our renowned Sheffield Business School.

- Explore topics from legal and ethical to economic and capital market environments.

- Learn from the professionally qualified experts who are active in research.

- Gain work-ready experience with real-life projects and placements.

On our BA (Hons) Accounting and Finance course you’ll gain a thorough understanding of financial and management accounting, auditing, tax, corporate reporting, governance, financial management and professional ethics. You'll learn the creation, analysis and critical evaluation of financial information – enabling you to make sound decisions and communicate complex data effectively.

Accredited by

This course is accredited by the Chartered Institute of Management Accountants (CIMA and the Institute of Chartered Accountants England and Wales (ICAEW).

Sheffield Business School accreditation

Sheffield Business School is accredited by the Association to Advance Collegiate Schools of Business (AACSB) and has been awarded the Business School Impact System label by the European Foundation for Management Development (EFMD).

Employability

95% of our graduates are in work or further study fifteen months after graduating (2021/22 Graduate Outcomes Survey).

Come to an open day

Visit us to learn more about our gold-rated teaching and why we were awarded the highest possible rating in the Teaching Excellence Framework.

2. How you learn

You’ll study in our Sheffield Business School, rated in the top 6% globally for excellence in teaching and research. Here, you’ll join a global community where business leaders, researchers and 6,500 business students all come together to solve problems and make things better.

Our academics are highly skilled professionals, bringing their cutting-edge knowledge and diverse experience into the classroom. Not only are they academically qualified – they’ve worked in various industries, with some actively engaged in current research.

You learn through:

- Lectures

- Tutorials

- IT sessions

- Regular formative feedback

- Teamwork and group-based learning

- Practice-based applied learning

- Authentic learning experiences

- Engagement with guest lectures

- Discussions

- Self-managed study

- Problem-solving

- Self-development activities

Key Themes

You’ll start by gaining a solid foundation in accounting and finance, along with practical skills for collecting and using accounting data to communicate with stakeholders. You’ll simultaneously enhance your understanding of the processes, tools, technologies and project management practices you’ll need to be successful.

As you progress, you’ll further refine these fundamentals through real-world projects – collaborating in teams to create reports, presentations and recommendations inspired by real industry challenges. This hands-on approach prepares you for careers in professional accountancy, business and finance, within a supportive learning environment.

In your final year, you'll undertake a consultancy project for a real organisation, guided by a dedicated project supervisor. In this capstone project, you'll conduct research and apply the knowledge and skills you’ve acquired throughout your studies.

We promote flexibility, aiming to empower you to customise your course to align with your interests and aspirations. You can choose elective pathways including forensic accounting, sustainable/environmental accounting, sports finance, and other traditional routes. There is also the opportunity after the first year to transfer to the BA (Hons) Accounting and Finance (Management) route, which although still aligned with professional bodies is mainly focussed on the Chartered Institute of Management Accountant, allowing more varied assessment and developing different kinds of transferrable skills.

Course Support

You’ll be supported in your learning journey towards highly-skilled, graduate-level employment. This includes:

- Access to specialist support services to help with your personal, academic and career development.

- Access to our Skills Centre for support with one-to-ones, webinars and online resources, where you can get help with planning and structuring your assignments and assessment preparation

- Industry-specific employability activities, including work placements, live projects and networking opportunities

Course leaders and tutors

Jayne Revill

Principal LecturerI am a principal lecturer in business systems and a member of the Department of Finance, Accounting and Business Systems. My main areas of focus are information syst … Read more

Applied learning

Live Projects

In the first and second years of your course, you’ll have opportunities to work for real client-based projects. Students have often found placements with their host company as a result of the excellent work they’ve done on these live projects.

You’ll carry out research and analysis to generate findings and recommendations that address clients’ business problems – which in the past have included product development for Marks and Spencer and Costa Coffee. You’ll present your findings to your clients, gaining valuable experience in professional practice.

Throughout all modules you study, we incorporate work-relevant content – including simulations, case studies, guest speakers and experiential activities. These not only help you seek potential career opportunities, but also feel confident in pursuing them.

Work Placements

You’ll have the opportunity to take part in an extended work placement between the second and third years of the course. This gives you hands-on work experience to prepare you for your future career – as well as an Applied Professional Diploma to add to your CV.

Previous students have worked at organisations such as AstraZeneca, BHP, GE Capital, IBM, Jaguar Land Rover, Mitchell’s Chartered Accountants, Morrisons, Nestlé, the Metropolitan Police, the NHS and the Royal Mail.

Networking Opportunities

Throughout the course, there are numerous opportunities for you to engage with career planning and development, career fairs and workshops, employer presentations and professional career advisors.

These are great chances to enhance your confidence, skills development and future employability.

3. Future careers

This course prepares you for a career in:

- Professional accountancy

- Finance or business management

- Entrepreneurship

- Tax consultancy/specialisms

- Academia

- Further education or graduate employment

Previous graduates of this course have gone on to work for:

- Asda

- Barber Harrison Platt

- BOC

- DLA Piper

- KPMG

- NHS

- PwC

- Sheffield Hallam University

- Virgin Media

- Vodafone

- Warner Music Group

4. Where will I study?

You study at City Campus through a structured mix of lectures, seminars and practical sessions as well as access to digital and online resources to support your learning.

City Campus

City Campus is located in the heart of Sheffield, within minutes of the train and bus stations.

City Campus map | City Campus tour

Adsetts library

Adsetts Library is located on our City Campus. It's open 24 hours a day, every day.

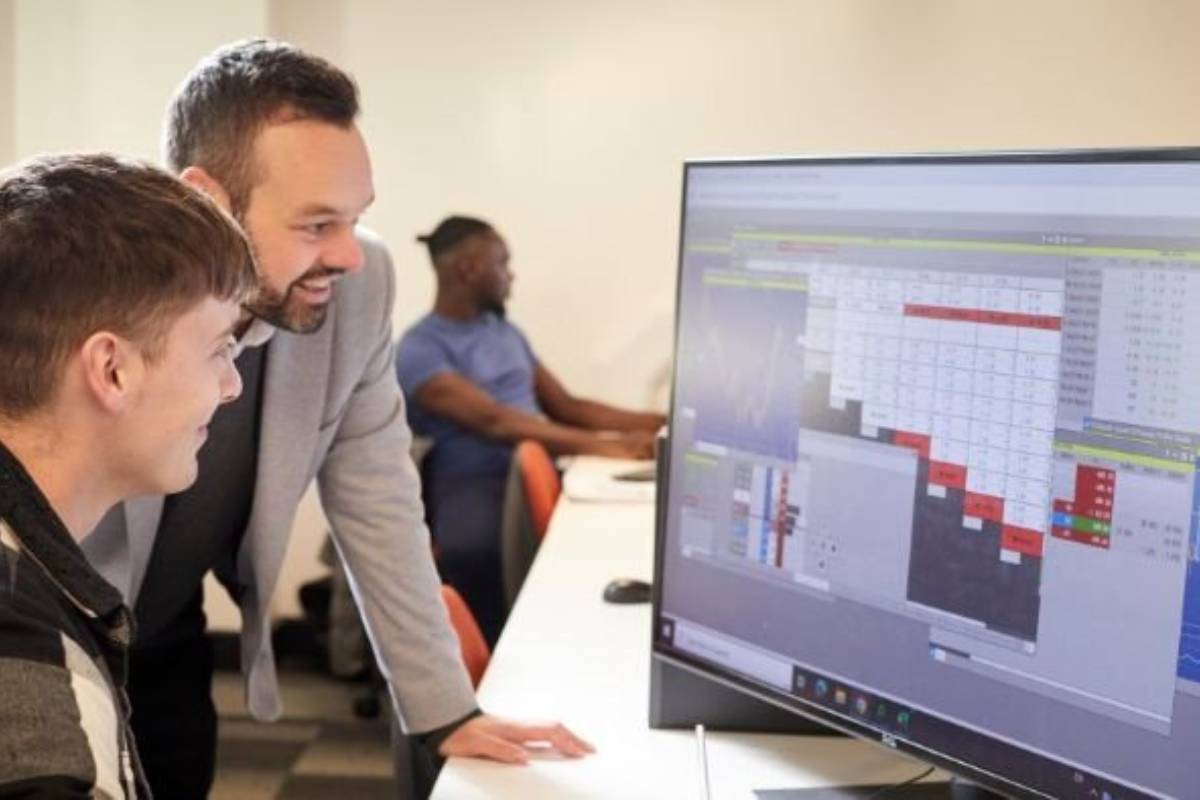

Learn more5. Equipment and facilities

Construction of the new Sheffield Business School is underway – providing state-of-the-art teaching and learning facilities and social space to students.

On this course, you’ll have access to:

- Our virtual learning environment – Blackboard sites

- Accounting software

- Bloomberg terminals

- Our financial trading floor

- A physical and online library with databases and digital books, journals, newspapers, and magazines

Media Gallery

6. Entry requirements

All students

UCAS points

- 112-120

This must include at least 64 points from 2 A Levels or equivalent BTEC qualifications. For example:

- BBC-BBB at A Level

- DDM in BTEC Extended Diploma.

- Merit overall from a T level qualification.

- A combination of qualifications, which may include AS levels, EPQ and general studies

We also expect you to demonstrate through your personal statement an interest in and awareness of accounting or some level of practical experience.

GCSE

- English language or literature at grade C or 4

- Maths at grade D or 3

GCSE equivalents

- Level 2 Literacy or Functional Skills Level 2 English

- Level 2 Numeracy or Functional Skills Level 2 Maths

You can find information on making sense of UCAS tariff points here and use the UCAS tariff calculator to work out your points.

• Access - an Access to HE Diploma with at least 45 credits at level 3 and 15 credits at level 2. At least 15 Level 3 credits must be at merit grade or above, from a QAA-recognised Access to HE course, or an equivalent Access to HE certificate.

If English is not your first language you need an IELTS score of 6.0 or above, with a minimum score of 5.5 in each skill.

You can apply for advanced entry on to this course, depending on the number of professional accountancy examinations you have passed.

If you do not have any of the qualifications above but have relevant experience you are welcome to discuss potential opportunities with the admissions tutor.

Additional information for EU/International students

If you are an International or non-UK European student, you can find out more about the country specific qualifications we accept on our international qualifications page.

For details of English language entry requirements (IELTS), please see the information for 'All students'.

Modules

Important notice: The structure of this course is periodically reviewed and enhanced to provide the best possible learning experience for our students and ensure ongoing compliance with any professional, statutory and regulatory body standards. Module structure, content, delivery and assessment may change, but we expect the focus of the course and the learning outcomes to remain as described above. Following any changes, updated module information will be published on this page.

You will be able to complete a placement year as part of this course. See the modules table below for further information.

Compulsory modules

Module Aim:

The module aims to provide students with a solid foundation in the fundamental concepts and theories of economics. The module introduces students to the principles of micro and macroeconomics. It seeks to equip students with the analytical tools necessary to understand and evaluate economic issues and policies in a wide range of contexts. Additionally, the module aims to cultivate problem-solving skills by encouraging students to apply economic theories to real-world situations.

Indicative content:

Microeconomics

- Demand and Supply Analysis

- Elasticity of Demand and Supply

- Consumer Choice Theory

- Production Theory and Cost Analysis

- Perfectly Competitive Markets

- Monopoly and Monopolistic Competition

- Oligopoly and Game Theory

- Externalities and Public Goods

Macroeconomics

- Gross Domestic Product (GDP)

- Unemployment and Inflation

- Aggregate Demand and Aggregate Supply

- Fiscal Policy

- Monetary Policy

- International Trade and Exchange Rates

- Economic Growth and Development

This module provides students with an introduction to financial accounting, starting with the basics of double entry bookkeeping and progressing to the preparation of financial statements for limited companies. You’ll explore underlying principles, concepts and the international regulatory framework for financial accounting, while developing important IT, Excel and Sage skills from lectures, seminars and software usage.

You’ll study topics such as:

-

Accounting objectives, concepts, conventions and regulations

-

International financial reporting standards

-

Ledger accounting and double entry bookkeeping

-

Accruals and prepayments

-

Tangible non-current assets

-

Bad debts and allowance for receivables

-

Cost of goods sold and inventories

-

Bank reconciliations

-

Control accounts and error correction

-

Preparation of financial statements for sole traders and limited companies

This module introduces business and company law – and its application in organisations with different legal structures – through a mix of lectures, seminars and software usage. You’ll gain an understanding of corporate governance, the ability to apply those principles in an organisational context, and the chance to reflect on ethical situations in a professional context.

You’ll study topics such as:

-

Types of legal entity

-

Company and insolvency law

-

The English law of contract

-

The English law of employment

-

Criminal behaviour that may be encountered by professional accountants

-

English law pertaining to debt, equity and reserves

-

Corporate governance

-

Corporate social responsibility

-

Ethics

This module introduces management accounting terminology, concepts and theories in lectures and seminars, while developing your management accounting skills in an applied project working with a client. You’ll build your competencies and professional skills in management accounting methods and techniques, enabling you to identify and solve problems in organisational contexts.

You’ll apply learning and skills such as:

-

Management accounting in manufacturing, retail and service organisations

-

Identifying cost behaviour and classification

-

Preparing overhead analysis sheets (including reciprocal service departments)

-

Preparing profit statements, absorption, marginal costing and reconciliation

-

Applying marginal and full cost pricing to achieve a target profit

-

Break-even, profit target, margin of safety and contribution/sales ratio

-

Short-term decision-making techniques

-

Functional budgets, budgeted profit statements and simple cash budgets

-

Fixed vs flexible budgets and expenditure, volume and variances

-

Variances for sales, materials, labour, variable overheads, and fixed overheads

Compulsory modules

This module develops critical understanding of the nature and purpose of international auditing – and the related commercial and regulatory systems. Through lectures and seminars you’ll gain an understanding of information and control systems in modern business, while developing knowledge of international practices, techniques and outcomes of the audit process.

You’ll study topics such as:

-

Assurance engagements

-

Auditing postulates concepts

-

Agency theory

-

Comparative roles of the external and the internal auditor

-

Professional ethics including independence and objectivity

-

The regulatory framework of international auditing

-

Audit risk, planning, evidence and reporting

-

Issues in auditing and corporate governance in international organisations

This module builds your knowledge of single company financial statements, looking at more complex transactions and situations and applying the relevant international financial reporting standards. Through lectures and seminars you’ll learn to prepare simple consolidated financial statements, explaining the underlying accounting principles behind such statements, and understanding of the impact of taxation on business accounting and reporting.

You’ll study topics such as:

-

Preparation and presentation of single company and consolidated financial statements

-

Statements of profit of loss and other comprehensive income

-

Statements of financial position

-

Statements of changes in equity (single company only)

-

Statements of cash flows (single company only)

-

International financial reporting standards

-

Principles of business taxation

This module applies management accounting concepts and techniques to generate information for effective decision-making in organisations, from working capital management to controlling present and projected performance of organisations. Through an immersive work experience in partnership with external organisations, you’ll choose between alternative sources of finance and critically evaluate the effect of financing decisions on a business.

You’ll apply your learning and skills to:

-

Multiple product break even

-

Pricing

-

Advanced variance analysis: sales, mix and yield, planning and operational

-

Working capital management

-

Equity finance and debt finance

-

Weighted average cost of capital

-

Advanced budgetary control and activity-based, zero-based and planned programme budgeting

-

Investment appraisal

Elective modules

This module explores the history of electronic crime in an international context, developing your ability to identify common threats and vulnerabilities in organisational information systems – from hacking and virus injections to manual fraud and its detection through AI and Blockchain. Through group sessions and discussions, you’ll assess the impact on organisations and individuals of the major types of electronic crime, evaluating the protection and assurances available to minimise the risks of such crimes.

You’ll study topics such as:

-

The vulnerabilities of information systems

-

The internet and the e-debate

-

The framework of the attackers and the classification of threats and attacks

-

Managing the digital risks

-

Hackers, hacking and social engineering

-

Denial of service attacks – DOS, DDOS, botnets and malware

-

Emerging technologies and ‘smart’ businesses

-

Digital forensics and technological protection

-

Legislation, law enforcement, governance and social issues

-

The evolution of cyber crime

This module develops your skills and knowledge in detecting fraud in accounting records, preparing you for the world of big data. You’ll focus on data management skills for importating and analysing data sets in Excel, and data science techniques to identify common types of fraud within organisations.

You’ll study topics such as:

-

Overview of the fraud landscape

-

Different types of fraud that can take place within an organisation

-

High level data analysis

-

Duplicates and matching

-

Verification of information using secondary data

-

Benford’s law

-

Correlation

-

Significance testing

-

Time series analysis

-

Interpretation and presentation of results

-

Limitations in analytics techniques

Module Aim:

The Global Climate Emergency module aims to enable students to learn in a multi-disciplinary and international environment, focussed on introducing the biggest challenge in the world – the Climate Emergency. The module will develop applied knowledge, skills and values that empower students to understand climate action and act as informed, engaged, responsible and responsive global citizens.

Workshops, classroom, online, international collaboration

Indicative content:

Global environmental change and drivers of the climate crisis

The uneven impacts of the climate crisis on society, nature and the environment

An international view of social justice and human rights with respect to the Climate Emergency

Introduction to international agreements and frameworks, such as the Sustainable Development Goals, relevant to the Climate Emergency

An exploration of climate solutions, mitigation and adaptation An introduction to governments, organisations and business in driving change

The economic challenges and opportunities of climate change

Driving change through activism, communication and media

This module develops your critical understanding of the UK tax system for both individuals and businesses. Through lectures and seminars, you’ll work with complex tax calculations and present that information to relevant individuals and organisations.

You’ll study topics such as:

-

The UK tax system, the economy, revenue law, tax avoidance and tax evasion

-

The scope and calculation of employment, property and investment income tax

-

Plant, machinery, motor vehicle and building capital allowances

-

The scope of corporation tax, chargeable profits, income and gains

-

Computation of corporation tax liability and relief for trading losses

-

The scope of capital gains tax and the calculation of chargeable gains and losses

-

National Insurance contributions for the self-employed, employed and employers

-

VAT registration, compliance requirements and computation of VAT liabilities

-

The obligations of taxpayers, self-assessment system, enquiries and non-compliance

-

The use of tax reliefs and tax planning for both individuals and business

This module introduces sports business management in the UK and globally. We’ll cover key concepts related to sports business management – such as organisational behaviour, social responsibility, policy, finance and governance.

You’ll study topics such as:

-

The voluntary sector of sport

-

The public of sport

-

The private sector of sport

-

Corporate social responsibility in and through sport

-

Governance and legal issues in sporting sectors

-

Financial analysis of sport organisations

Optional modules

Module aim:

The aim of this module is to enhance students’ professional development through the completion of and reflection on meaningful work placement(s).

A work placement will provide students with opportunities to experience the realities of professional employment and experience how their course can be applied within their chosen industry setting. The placement will:

-

Allow student to apply the skills, theories and behaviours relevant and in addition to their course

-

Enable students to enhance their interpersonal skills in demand by graduate employers – communication, problem solving, creativity, resilience, team work etc.

-

Grow their student network and relationship building skills.

-

Provide student with insights into the industry and sector in which their placement occurs

-

Help student make informed graduate careers choices.

Indicative Content:

In this module students undertake a sandwich placement (min 24 weeks / min 21 hours per week) which is integrated, assessed and aligned to their studies.

Their personal Placement Academic Supervisor (PAS) will be their key point of contact during their placement and will encourage and support students to reflect on their experience, learning and contribution to the organisation they work for.

To demonstrate gains in professional development, students will be required to share their progress, learning and achievements with their Placement Academic Supervisor and reflect on these for the summative piece of work.

Compulsory modules

This module develops skills through real-world consultancy intervention in lectures, team meetings and visits to client premises, exploring strategic management accounting areas aligned to strategy and internal performance metrics. You’ll analyse the behavioural implications of applying different performance measurement methods – financial and non-financial – to motivate and evaluate performance of responsibility centre managers.

You’ll apply skills and learning such as:

-

Consultancy and team-work

-

Communication and inter-personal skills

-

Real-life consultancy projects working with industry partners

-

Industry client visits

-

Work in cross-discipline teams

-

Reflection on current knowledge, skills and abilities

-

Strategic management theories and evaluation of strategic options

-

Environment appraisal techniques and application

-

Corporate position audit analysis and management

-

Environment, strategy, management accounting and control systems

This module develops your understanding of corporate reporting and governance through lectures, seminars and relevant software, using the UK Corporate Governance Code as a case study. You’ll explore the ways standards are created by the different regulatory bodies, their remits, and how they enhance standards of reporting and governance within the UK and beyond.

You’ll study topics such as:

-

Interpretation of annual report and accounts in financial and narrative reporting

-

Research and enquiry techniques related to financial and narrative reporting

-

International accounts and sustainability setting boards (IASB/ISSB)

-

The Financial Reporting Council (FRC) / the Audit, Reporting and Governance Authority (ARGA)

-

Corporate social responsibility (CSR)

-

Sustainability and environmental, social and governance (ESG)

-

Corporate governance frameworks and developments

-

Company purpose, shareholders, stakeholders, the board, accountability and remuneration

-

The effectiveness of the governance and agency system of an organisation

-

Social responsibilities and reporting implications

Elective modules

This module develops your knowledge and understanding of the UN Sustainable Development Goals, including their conception and impact. Through lectures and seminars, you’ll explore the role of organisations in implementing and measuring sustainable development performance.

You’ll study topics such as:

-

Sustainable Development Goals (SDGs)

-

Impact on global politics, economies and businesses

-

The role of organisations in addressing SDGs

-

Integrating SDGs into organisational strategy and operations

-

Accounting for sustainable development performance

This module develops higher level financial accounting skills, from the preparation of single company financial statements to critical evaluation of advanced accounting transactions. Through lectures, seminars and relevant software, you’ll explore underlying International Financial Reporting Standards and emerging issues in financial reporting and accounting practices.

You’ll study topics such as:

- Accounting for assets, including impairment for cash-generating units

- Provisions, contingent liabilities and contingent assets

- Taxation, including deferred taxation

- Revenue, multiple performance obligations and variable considerations

- Financial instruments, debt equity and convertible instruments

- Foreign currency transactions

- Preparation and interpretation of consolidated financial statements

- Accounting for complex and sub-subsidiary group organisations

- Consolidated statements of cash flow

This module deepens your knowledge of the strategic decisions made by large corporates, challenging key theories and strategic management decisions – from international financing to investment. You’ll learn through a series of keynote lectures supported by seminars, testing your understanding of theories and how they influence decision-making techniques for managers.

You’ll study topics such as:

-

The strategic concept of corporate finance

-

Advanced financing techniques, convertibles, warrants, dual listings and euro-bonds

-

Optimal capital structure theory and capital structure in practice

-

The theory of dividend policy and company dividend policies in the real world

-

Portfolio theory and the capital asset pricing model (CAPM)

-

Mergers and acquisitions, company valuation and takeovers

-

International investment appraisal and modes of entry

-

The triangle of financing, investment appraisal and dividend decisions

-

Strategic decisions to create and maximise shareholder wealth

This module develops your critical understanding of forensic accounting, the role of the expert witness and the nature and extent of financial dispute resolution. You’ll learn to apply the techniques used in forensic accounting engagements – from the identification of admissible evidence to the quantification of damages – thinking critically, evaluating evidence and coming to reasoned conclusions.

You’ll study topics such as:

-

The role of the expert and courtroom skills

-

Loss of profits calculations

-

Financial and business analysis

-

Financial valuation techniques

-

Professional negligence actions

-

Personal injury claim

-

Matrimonial disputes

This module develops your understanding of forensic investigation and financial crime, using a range of case studies to explore the application of techniques used in forensic investigation engagements. Through lectures, seminars and relevant software, you’ll learn to identify and critically evaluate situational, systems and security weaknesses in organisations, designing and recommending measures to minimise the associated downside risks.

You’ll study topics such as:

-

Risk management within business and personal financial exposures

-

Corporate risk assessment procedures

-

Financial and organisational control systems

-

Financial and business analysis

-

Forensic auditing and evidence collection

-

Financial investigation techniques

-

Aggressive and off-balance sheet accounting procedures

-

Interviewing skills in a fraud investigation

This module analyses and evaluates the peculiar economics and characteristics of professional team sports, using an economics and finance-based conceptual framework. This module relates directly to professional team sports, given their unique structure and governance.

You’ll study topics such as:

-

Economic concepts

-

Market and structure of professional sport leagues

-

Competitive balance

-

Broadcasting

-

Managerial change

-

Performance measurement

-

Financial analysis

This module develops your understanding of the current state and potential of social and environmental accounting, including practice, policy and regulations. Through lectures and seminars you’ll learn how to apply knowledge in different organisational contexts – in both reporting and management accounting contexts.

You’ll study topics such as:

-

Theory and motivations for social and environmental accounting

-

Sustainability reporting frameworks, policy and regulations

-

Accounting for the environment and social issues

-

Sustainability management accounting

-

Accounting for non-for-profit and sustainable organisations

-

Sustainable finance and responsible investment

This module examines the context of governance, ownership structure and regulation in a variety of sport industries and organisations.

You’ll study topics such as:

-

Corporate governance theories

-

Sport governance structures

-

Ownership models and theories

-

Sport ownership structures and models

-

Sport regulation structures and frameworks

-

Regulation theories

8. Fees and funding

Home students

Our tuition fee for UK students on full-time undergraduate courses in 2025/26 is £9,535 per year (capped at a maximum of 20% of this during your placement year). These fees are regulated by the UK government and therefore subject to change in future years.If you are studying an undergraduate course, postgraduate pre-registration course or postgraduate research course over more than one academic year then your tuition fees may increase in subsequent years in line with Government regulations or UK Research and Innovation (UKRI) published fees. More information can be found in our terms and conditions under student fees regulations.

International students

Our tuition fee for International/EU students starting full-time study in 2025/26 is £17,155 per year (capped at a maximum of 20% of this during your placement year)

Financial support for home/EU students

How tuition fees work, student loans and other financial support available.

Additional course costs

The links below allow you to view estimated general course additional costs, as well as costs associated with key activities on specific courses. These are estimates and are intended only as an indication of potential additional expenses. Actual costs can vary greatly depending on the choices you make during your course.

General course additional costs

Additional costs for Sheffield Business School (PDF, 255.6KB)Legal information

Any offer of a place to study is subject to your acceptance of the University’s Terms and Conditions and Student Regulations.